The fitness industry is shifting from “high-end” to “small and beautiful,” and from ‘standardization’ to “personalization.” —Text by Ma Lianhong

“The government is calling on you to lose weight!”

Recently, Lei Haichao, director of the National Health Commission, mentioned at a press conference during the National People’s Congress that the government will continue to promote the three-year “Weight Management Year” campaign to promote healthy lifestyles. Suddenly, the topic of weight loss quickly became a hot search topic, showing that weight has become a problem for many people.

When it comes to weight loss, the best approach is fitness. According to the recently released “2024 China Sports and Fitness Industry Data Report,” in 2024, there were approximately 169,000 sports and fitness facilities nationwide, with 87.525 million professional fitness members, representing a year-on-year increase of 25.47%. The average number of monthly workouts was five or more.

This report also reveals a new consumer profile for mass fitness: in gyms, consumer spending is concentrated below 3,000 yuan, with a significant loss of high-spending consumers, indicating a clear trend toward downgrading consumption within the industry; fitness apparel spending is also concentrated below 3,000 yuan, with women increasingly becoming regulars at 24-hour fitness facilities, and the number of 24-hour fitness centers exclusively for women has already exceeded 1,000.

The traditional model is fading away, with 24-hour self-service fitness taking over second- and third-tier cities

The “2024 China Sports and Fitness Industry Data Report” was jointly produced by the National Sports总局, the China Bodybuilding Association, the School of Economics and Management at Shanghai University of Sport, SanTi YunDong, and the IWF International Fitness Expo, and was officially released at the 2025 IWF Shanghai International Fitness Expo.

For the fitness industry, 2024 is a year of significant change. There are approximately 169,000 sports and fitness venues nationwide, including 26,000 sports and leisure venues and 143,000 broad-category fitness venues. The number of broad-category fitness venues, which are more closely related to fitness, increased by 26,000 year-on-year, marking the first recovery after three consecutive years of decline following the outbreak of the pandemic. Notably, this data includes 72,000 professional fitness venues (last year’s figure was close to 80,000) and 71,000 general fitness venues, such as yoga studios, taekwondo studios, and karate studios.

Traditional commercial gyms, 24-hour self-service fitness venues, boutique studios, and online fitness platforms coexist, each exploring different development directions.

The report compiled three rankings based on store operation models: the China Fitness Club Brand Ranking, the China Fitness Studio Brand Ranking, and the 24-Hour Fitness Brand Ranking, showcasing the new competitive landscape in the fitness industry.

In the China Fitness Club Brand Ranking, brands such as One Megawatt, Comfort Castle Fitness, Miracle Fitness, Powerhouse Fitness, China Aviation Fitness Club, and Limeijian are no longer listed, signaling the end of the traditional fitness club model.

Source: “2024 China Sports and Fitness Industry Data Report”

Zhongtian Fitness leads the rankings with 1,801 stores, representing a 27.1% increase compared to 2023; FEELINGME Leike Private Training Studios ranks second with 350 stores. FEELINGME Leike Private Training Studios, which primarily operates on a monthly subscription model, is currently present in 16 cities across China, all of which are major domestic cities;

Super Gorilla, which primarily operates group class-based fitness studios, has seen a significant decline in the number of its stores, dropping from 223 in 2023 to 131, a decrease of 41.3%. However, it can also be observed that while closing stores, Super Gorilla is also experimenting with new business models. For example, its mini-program features stores offering rehabilitation, meditation, pole dancing, and archery services. This indicates that while closing stores, Super Gorilla is actively exploring other business areas and transitioning toward a platform-based model, similar to ClassPass, which operates as a booking platform for fitness sessions.

The 24-hour fitness brand rankings have also undergone significant changes. LeKue Sports leads with 1,524 stores, which is seven times more than the second-place brand, JianDan Sports. From a brand perspective, the rankings include familiar names like LeKe Sports, JianDan Sports, FaTiaoYa, and LIKING FIT, as well as newly emerging brands such as JinLiHao 24-Hour Fitness, Metal Dog Shared Fitness, FanTieDeLi 24-Hour Self-Service Fitness, Time Machine 24-Hour Self-Service Fitness, 123FIT 24-Hour Self-Service Fitness, 24/7FIT-NESS, and Panda Fitness. In addition to first-tier and new first-tier cities, second- and third-tier cities have also become key markets for 24-hour fitness brands.

Source: “2024 China Sports and Fitness Industry Data Report”

Additionally, in terms of category, the number of yoga/Pilates studios reached 38,461, representing a year-on-year increase of 20.32%. These studios are distributed across all regions of the country and have clearly become one of the mainstream fitness options.

The decline of traditional gyms is not accidental but a inevitable consequence of market selection and consumer upgrading. The rise of 24-hour self-service fitness has not only lowered the barriers to entry for fitness but also injected new vitality into the industry. In the future, traditional gyms must innovate their business models and enhance user experience to survive.

Fitness consumption is rebounding, with lightweight consumption emerging as a new trend.

The report also highlights several new trends in sports consumption.

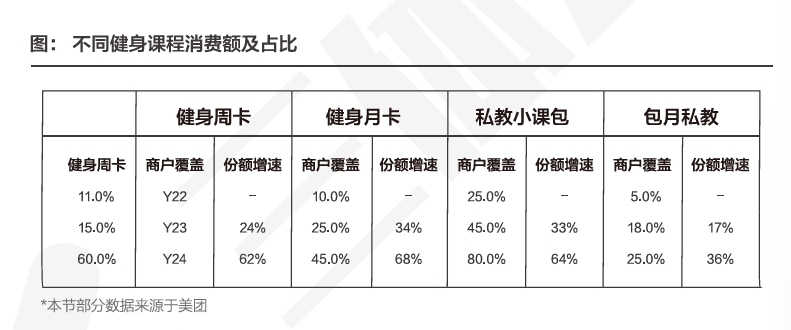

First, lightweight consumption models such as monthly and weekly payments are gaining traction.

Looking at specific fitness consumption data, aside from general sports activities, consumers’ purchases of monthly fitness passes, private training packages (10 sessions or fewer), and weekly fitness passes saw rapid growth in 2024, with growth rates exceeding 60%. Compared to annual passes and other long-term fitness services, weekly and monthly passes offer greater flexibility and more affordable pricing.

Second, the 60-64 age group is the main force in senior fitness.

Taking the Shanghai Senior Fitness and Health Center as an example, in 2024, among the people exercising at the Senior Fitness and Health Center, women accounted for 60.69% and men accounted for 39.31%, with women significantly outnumbering men. From an age distribution perspective, the 60-64 age group had the highest proportion of seniors, reaching 19.4%. This age group has recently entered the elderly stage, with relatively good physical functions and a strong pursuit of a healthy lifestyle, making them more willing to participate in fitness and health activities; The group aged 55 and under accounted for 18.7%. This demographic may have joined the Senior Fitness and Health Center earlier due to their proactive focus on health.

Three, Fitness Consumption Recovery

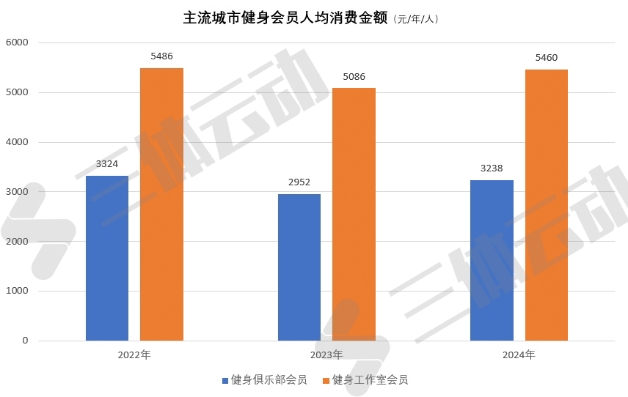

In 2024, the average per-capita spending on fitness memberships in major cities gradually recovered. The average per-capita spending on fitness club memberships in 2024 was 3,238 yuan, while the average per-capita spending on fitness studio memberships reached 5,460 yuan. Both fitness club and fitness studio memberships exceeded the levels of 2023 and matched those of 2022.

In 2024, the average monthly revenue per store for fitness clubs in China’s major cities was 373,000 yuan, a 7.21% decline from the average monthly revenue of 402,000 yuan in 2023. In 2024, the average monthly revenue per store for fitness studios in China’s major cities was 98,000 yuan, which remained largely unchanged from the average monthly revenue in 2023.

Whether it’s a fitness club or a fitness studio, the main sources of revenue for stores include membership cards, personal training, course packages, prepaid cards, small group classes, group classes, online stores, and deposits. In fitness clubs, personal training revenue remains a key source of income, accounting for 52.90%, while membership card revenue makes up 35.41%, with the two combined accounting for a staggering 88.31%.

In fitness studios, there have been some changes in 2024, with private training and course package income sources dominating at 77.24%. Here, course packages are essentially another form of personal training sessions. Under normal circumstances, personal training sessions have a minimum number of sessions required for purchase, which can result in a high upfront cost for consumers. Course packages, however, reduce the number of sessions required, such as 3 or 5 sessions, thereby lowering the barrier to entry for members to purchase personal training sessions. This is also one of the ways fitness studios attract new customers. Additionally, membership card revenue sources for fitness studios saw a slight increase compared to 2023, reaching 12.14%. The monthly membership model is becoming increasingly common in fitness studios, as it not only improves facility utilization but also boosts store revenue.

The report indicates that fitness consumption is showing a clear downward trend, with mass consumption spending concentrated below 3,000 yuan and a significant loss of high-spending consumers. At the same time, lightweight consumption models such as monthly and weekly passes are growing rapidly, with growth rates exceeding 60%. This trend reflects consumers’ pursuit of flexibility and value for money.

However, the downgrade in consumption does not mean that the fitness industry is shrinking; rather, consumers are becoming more rational and pragmatic. The popularity of lightweight consumption models presents new growth opportunities for the industry. Fitness facilities can attract more users by lowering consumption barriers and offering diversified services.

The fitness industry continues to move toward smaller, more personalized, and customized offerings.

At the same time as the report was released, Dou Ying, co-founder and CEO of SanTi YunDong, also predicted future trends and changes in China’s fitness industry:

First, the fitness market will become increasingly segmented, with 24-hour self-service gyms, iron gyms, women-only fitness centers, and more.

Second, regional chain operations will emerge, potentially limited to a single province or even a specific city, with business models including direct operation, franchising, and joint ventures. SanTi YunDong’s client NRG Fitness Studio operates exclusively in Shanghai with over 60 branches. Fitness-related venues are also on the rise.

Third, fitness-related venues are continuing to rise. In 2024, there was a significant increase in the number of tennis venues, particularly 24-hour tennis training centers. This trend is expected to continue into 2025.

The author believes that the “2024 China Sports and Fitness Industry Data Report” is not only a summary of industry data but also a deep insight into the future development trends of the fitness industry. From the decline of traditional gyms to the rise of new models, from the emergence of the female market to the popularization of senior fitness, the report reveals the complex and profound changes the fitness industry is undergoing.

Overall, the fitness industry is shifting from “high-end and luxurious” to “small yet beautiful,” and from ‘standardization’ to “personalization.” Whether it’s the widespread adoption of 24-hour self-service fitness or the popularity of lightweight consumption models, these trends indicate that the industry is actively adapting to changes in consumer demand. Meanwhile, the rise of regional chain stores and multi-purpose fitness venues has provided new growth opportunities for the industry. The future fitness market will belong to those brands that can accurately capture consumer needs and adapt quickly.

Post time: Aug-15-2025