Exploring the development trends of the fitness industry is crucial for understanding the current market landscape and future direction. With the growing awareness of fitness among the general public and increasing policy support, China’s fitness industry is poised for rapid growth. This article will conduct an in-depth analysis of the development trends of China’s fitness industry from 2024 to 2025, exploring aspects such as policy support, the growth of the fitness population, and intense market competition, to reveal the challenges and opportunities facing the industry.

1. Multiple policies support the development of the fitness industry and raise public awareness of fitness.

Since the 18th National Congress of the Communist Party of China, China’s sports industry has flourished, with fitness becoming a national strategy in 2014. Data released by the National Bureau of Statistics shows that in 2017, the added value of China’s sports industry reached 781.1 billion yuan, with an average annual growth rate of 24.6% from 2014 to 2017. On September 2, 2019, the State Council’s General Office issued the “Outline for the Construction of a Sports Powerhouse,” outlining five strategic tasks. By 2035, the sports industry is expected to become a pillar industry of the national economy, with the sports industry’s share of GDP reaching approximately 4%. The state continues to introduce policies related to the sports industry, invest funds to strengthen fitness infrastructure nationwide, promote public awareness of sports and health, and drive the rapid development of the fitness industry.

2. Rapid Growth in the Fitness Population and Significant Market Development Potential

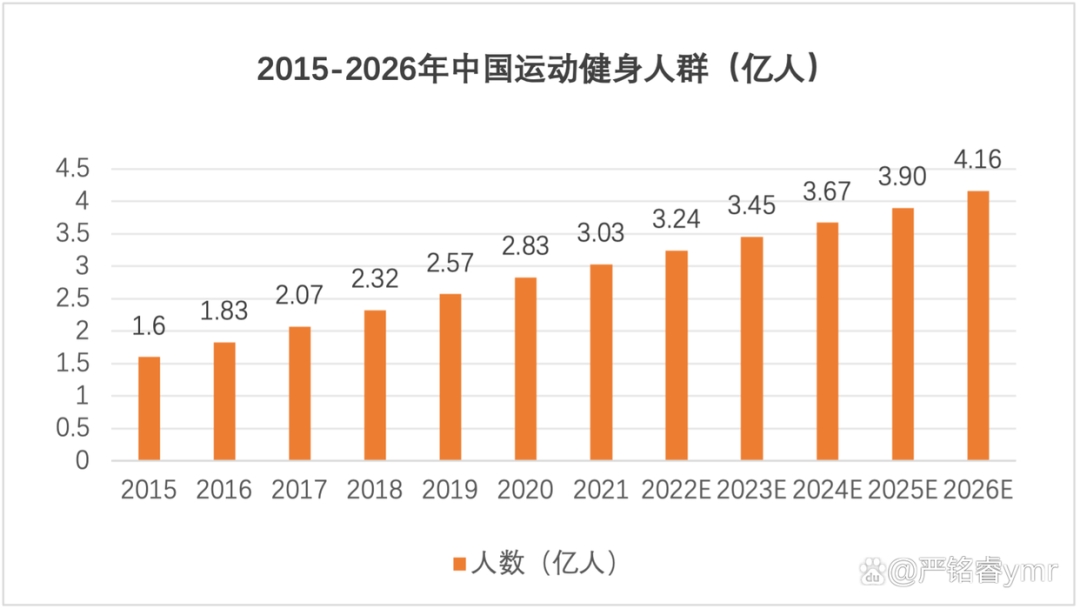

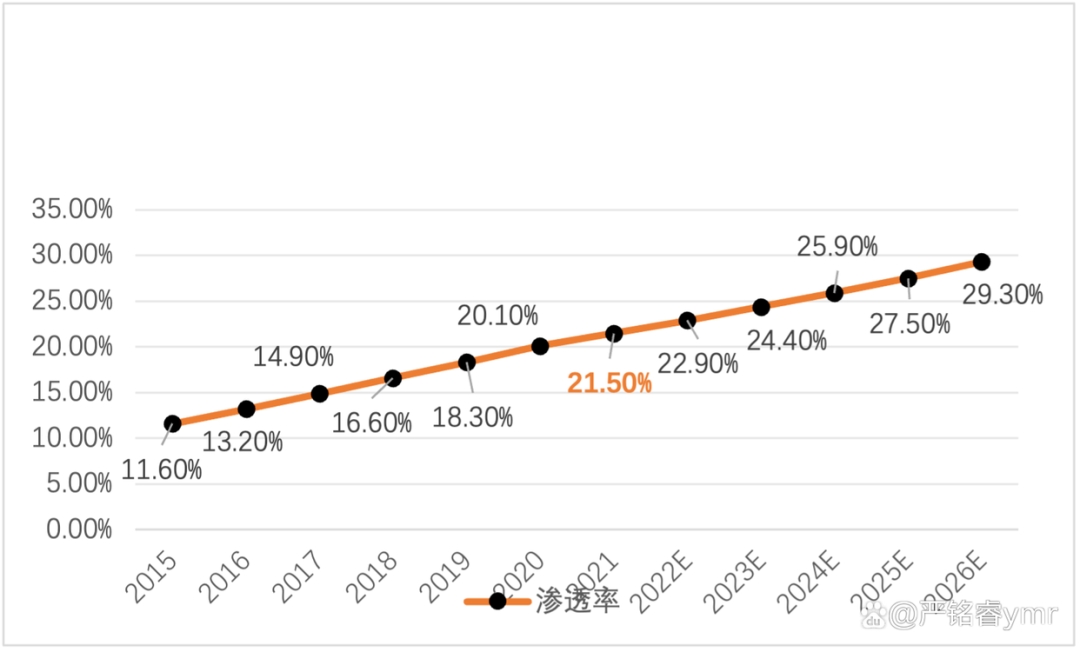

The number of fitness enthusiasts in China was 232 million, 257 million, 283 million, and 303 million in 2018, 2019, 2020, and 2021, respectively. According to statistics from the China Aviation Securities Research Institute, as of December 31, 2020, China was the country with the largest number of fitness enthusiasts globally (i.e., individuals who engage in fitness activities twice or more per week). It is projected that from 2021 to 2026, China’s fitness population will grow at a compound annual growth rate nearly twice that of the United States and Europe, reaching 416 million by 2026. Despite the rapid growth, the overall penetration rate still has significant room for improvement. As shown in Figure 2, the penetration rate of fitness enthusiasts in Europe and the United States in 2021 is approximately twice that of China.

Figure 1: Trend chart of the number of people participating in sports and fitness in China from 2015 to 2026 (unit: 100 million people)

(Source: Zhuoshi Consultation, Keep Prospectus, AVIC Securities Research Institute)

Figure 2 Penetration rate of fitness enthusiasts in China

(Source: Zhuoshi Consultation, Keep Prospectus, AVIC Securities Research Institute)

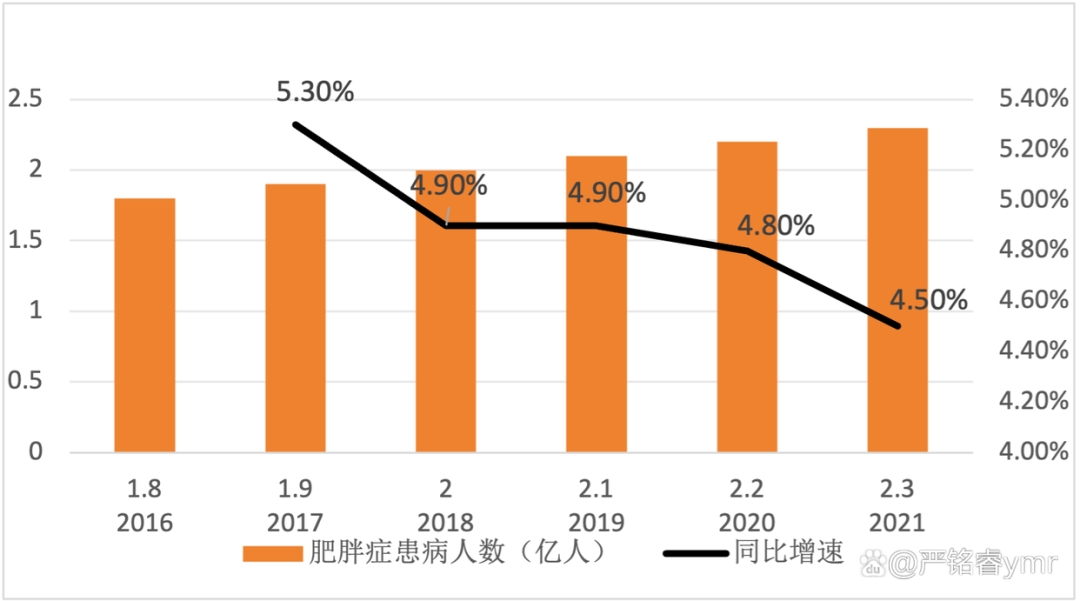

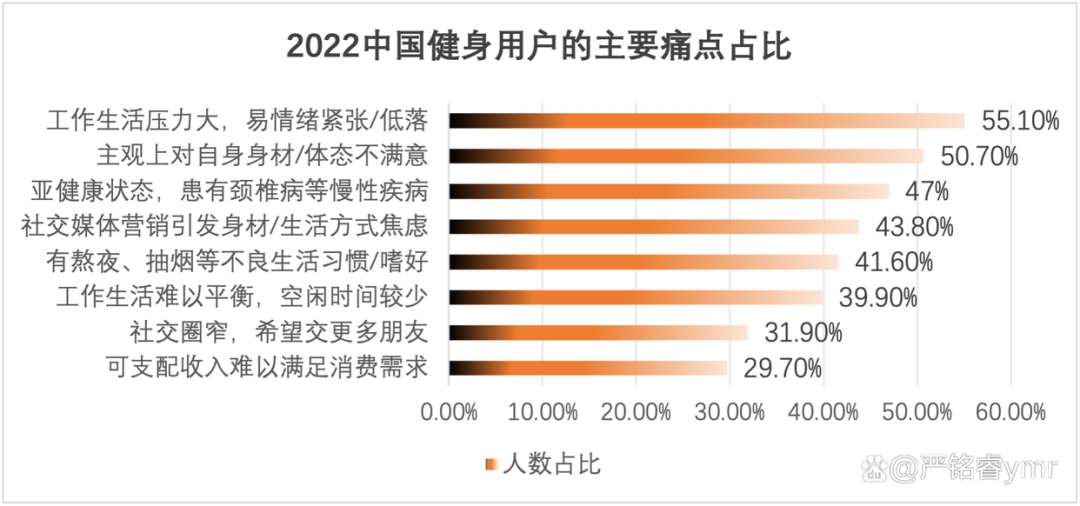

In recent years, issues such as sub-health conditions and emotional distress have become widespread, leading to an increased demand for fitness to improve physical health. As shown in Figure 3, obesity has become a growing concern among Chinese residents: by 2021, the number of people suffering from obesity in China is expected to reach 230 million, with the total number of overweight and obese individuals exceeding one-third of the population. According to data from Zhiyan Consulting, as China’s economy has developed rapidly and living standards have improved, the number of overweight and obese individuals is expected to continue growing in the future due to poor dietary habits and reduced physical activity. By 2025, the number of overweight and obese individuals in China may exceed 265 million. Additionally, the fast-paced lifestyle in urban areas has led to growing physical and mental health issues among residents, creating health challenges that have sparked a demand for fitness among residents, as shown in Figure 4. These factors indicate that there is a large potential fitness population in China, with more “newcomers” willing to try fitness in the future. At this point, it is highly suitable to establish fitness centers with low entry barriers, convenient locations, and facilities tailored for beginners.

Figure 3 Number of people with obesity in China from 2016 to 2021

(Data source: National Health Commission, National Bureau of Statistics)

Figure 4: Statistics on the main pain points of Chinese fitness users in their daily lives and work in 2022

(Data source: iResearch)

3. Intense market competition has exposed the shortcomings of the traditional fitness industry.

From a B2B perspective, traditional fitness services primarily consist of traditional gyms, modern gyms, and specialized fitness studios, which require significant capital investment, entail high operational costs, and have relatively high entry barriers. Their primary revenue models rely on selling membership cards and certain ancillary products. Additionally, cash flow is slow, expansion is slow, and in the highly commoditized fitness sector, if companies fail to accelerate their expansion and capture user mindshare, they may soon be eliminated from the industry.

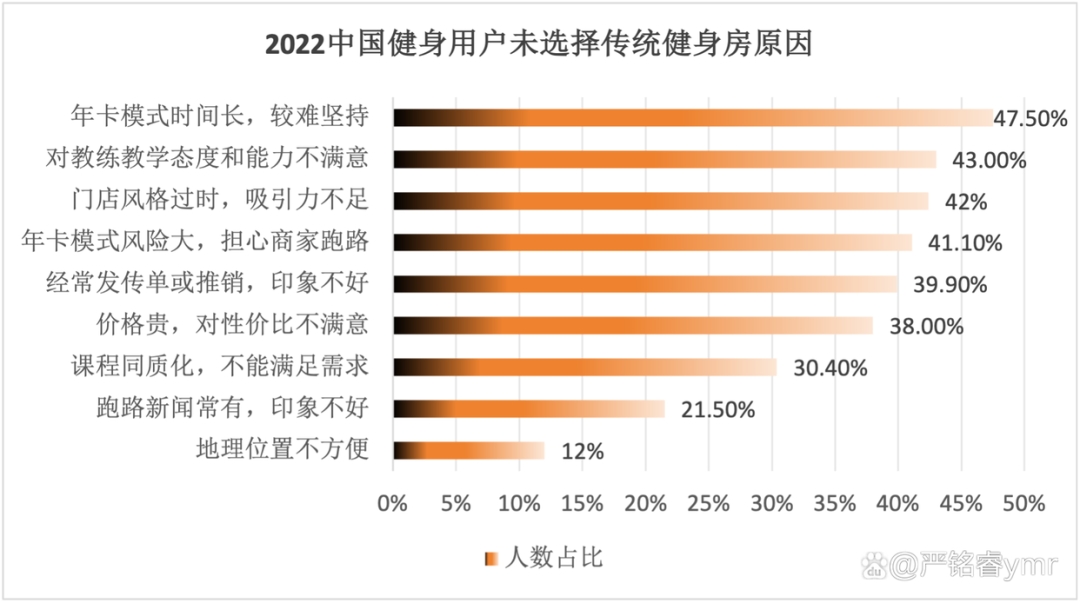

From the consumer perspective, the traditional annual membership model had high barriers to entry, required a high level of self-discipline, and posed significant risks, with many consumers worried about the possibility of businesses closing down. Additionally, since traditional gyms primarily rely on annual membership cards as their main source of income, they face high operational costs and significant cash flow requirements. As a result, traditional gyms place a strong emphasis on promoting annual membership cards, which can lead to a negative experience for consumers. As shown in Figure 5, iResearch Consulting has also conducted research and compiled the reasons why consumers are reluctant to choose traditional gyms. Considering both the B2B and B2C sides, there is significant market potential for creating a lean, low-cost, and customer-centric fitness market.

Figure 5: Statistics on the reasons why Chinese fitness users did not choose traditional gyms in 2022

(Data source: iResearch)

In summary, the Chinese fitness industry is showing several positive trends for 2024-2025. Policy support continues to strengthen, public awareness of fitness is steadily increasing, the number of fitness enthusiasts is growing rapidly, and market competition is intensifying. As the fitness industry rapidly develops, it also faces numerous challenges and areas for improvement. In the future, the fitness industry must continuously innovate, enhance service quality, and meet consumer needs to adapt to market changes and achieve sustainable development. With the support of policies and driven by market demand, China’s fitness industry is poised to embrace a more prosperous future.

The material in this article is sourced from the internet. If there is any infringement, please contact us to have it removed.

Post time: Aug-18-2025